EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

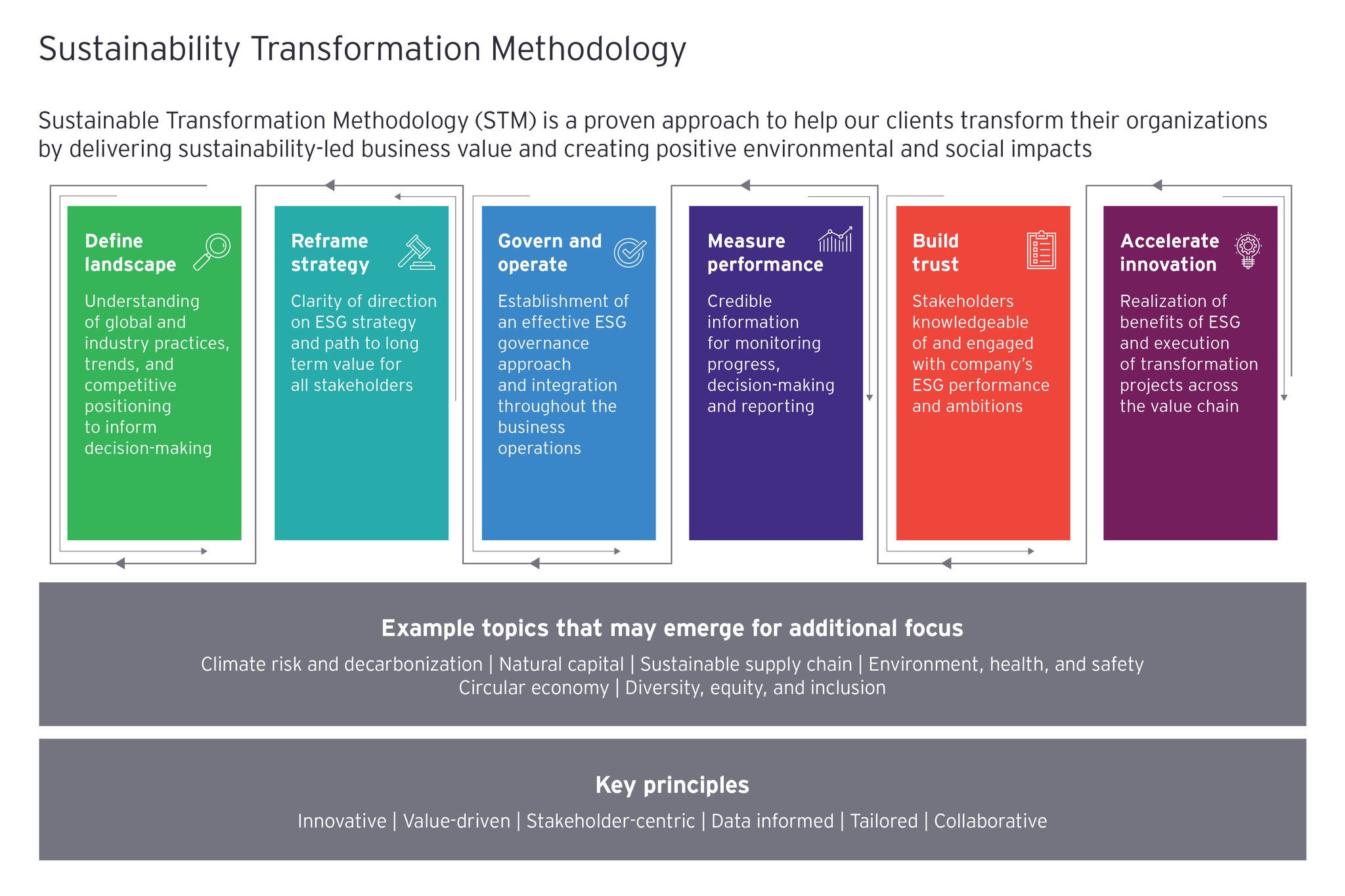

EY CCaSS teams can help address ESG and sustainability issues, investor concerns and improve ESG performance. Find out how.

Read more

The ESG movement: Embracing sustainability

The rise in global temperatures and the resulting increase in the frequency and severity of extreme weather events have cost the US economy $81 billion in damages in 2023 alone.ᶦ Climate change has disrupted supply chains, damaged infrastructure and increased operational costs. For example, the Panama Canal and surrounding region have seen historically low rainfall attributed to climate change that will cut the number of ship passages in half — from 36 per day in normal conditions to 18 per day in February 2024.ᶦᶦ This has increased the toll that each ship must pay to cross the Panama Canal and could force most ships to travel around South America, a journey that is thousands of miles farther. This is just one in a series of events from across the globe that underscore the urgent need for climate mitigation and adaptation strategies that not only solve for the challenges the natural world faces, but those that businesses and societies face as well.

In response to these challenges, there has been cross-industry coordination toward environmental, social and governance (ESG) action – with companies committing to ambitious climate targets and engaging on social issues. Over 6,500 companies worldwide have now set science-based targets,ᶦᶦᶦ committing to reduce their greenhouse gas emissions in line with a less than 2-degree Celsius future, as dictated in the Paris Agreement.ᶦᵛ Meanwhile, companies are experiencing increased customer, media, investor and regulatory scrutiny on a range of social issues. In response, companies are addressing gender, race and socioeconomic disparities in their workforce with revised talent policies and practices.

Embracing sustainability has translated to significant benefits for companies that have embedded ESG in their business strategies – further spurring the ESG movement. Studies from the last 30 years have shown that the financial performance of these companies has outpaced average industry performance. A positive correlation was found in 12 of 13 meta-analyses, encompassing 1,272 studies, between sustainability and financial performance. This correlation was attributed to the successful management of diverse stakeholders, creation of shared value for all parties involved, adherence to social contracts with society and strategic use of internal resources.ᵛ

Improving financial performance is also clearly represented through the success of ESG funds. Over the last 10 years, the performance of companies that Standard and Poor (S&P) had identified as having sustainable practices outpaced the general performance of the rest of the S&P 500; $100 invested in 2018 in the S&P 500 index is now worth $194 compared to $208 invested in the S&P 500 ESG Leaders fund, a fund holding securities of companies with stronger-than-average ESG characteristics that are also not involved in controversial business activities contributing to social or environmental harm. The encouraging story these financial metrics communicate is an additional motivation, beyond being a desirable place to work, to take a more proactive approach to sustainability to further capitalize on the benefits associated with ESG.