Sector abbreviations:

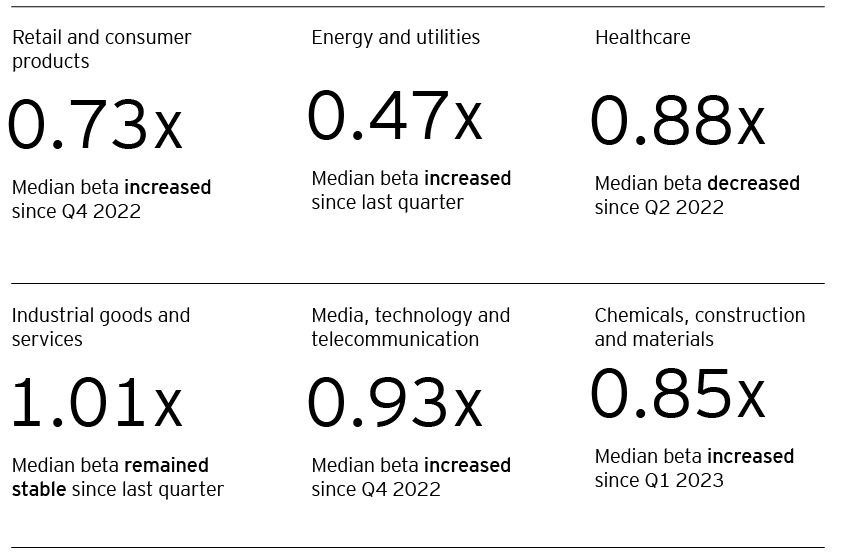

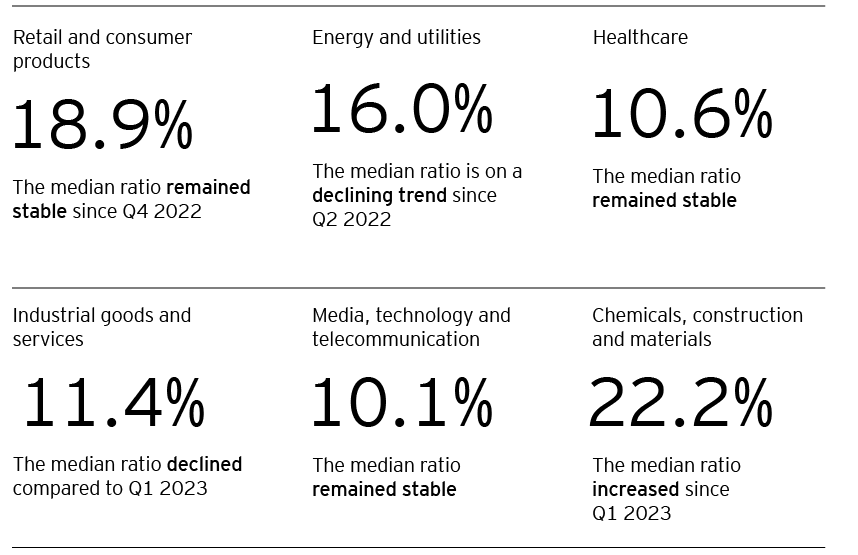

R&CP – Retail and consumer products

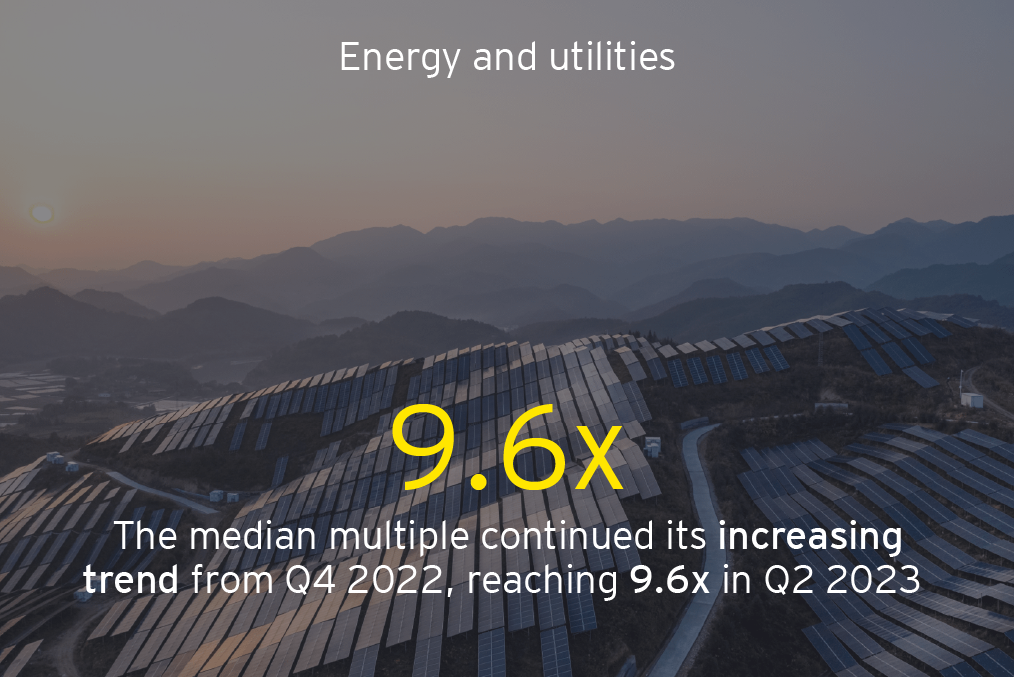

E&U – Energy and utilities

IG&S – Industrial goods and services

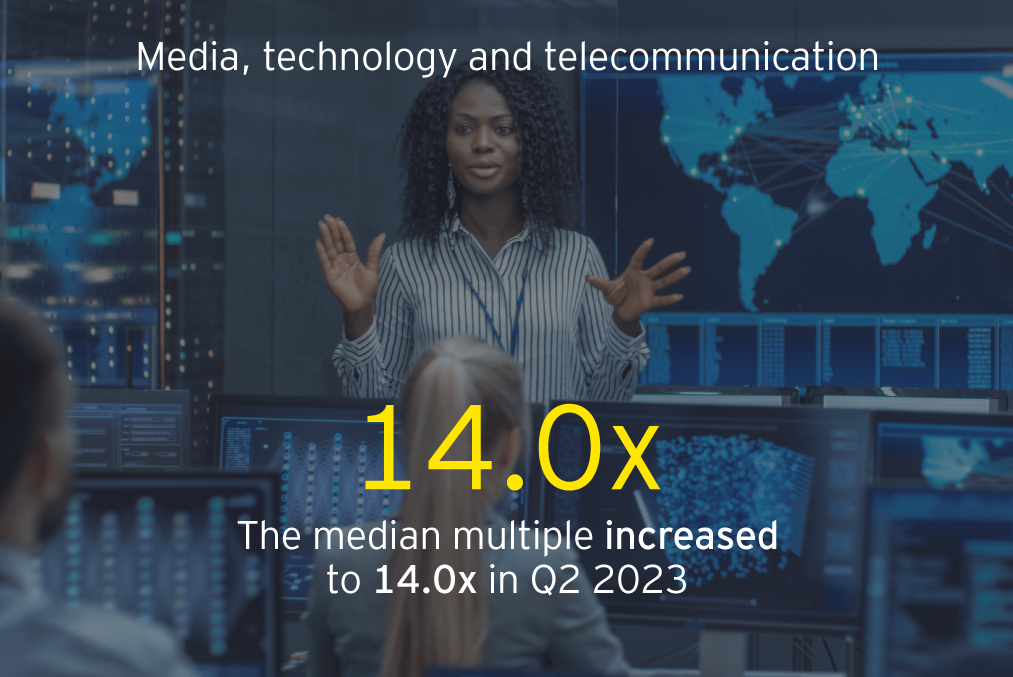

MT&T – Media, technology and telecommunication

CC&M – Chemicals, construction and materials

Summary

Our Valuation, Modeling & Economics Team is here to support you with Valuations, Liquidity & Scenario Planning, Portfolio Analysis, as well as other services to help you navigate through your action plans.

Acknowledgements

We thank Michael Keck, Alex Benhauresch, Jeremy Guttmann and Elizaveta Leontyeva for their valuable contributions to this article.